Posted on September 30, 2021 by Mehdi Berriah

By Mehdi Berriah

This is part four in a series of four posts on the financing of jihād during the Mamlūk period.

As noted by Ibrāhīm b. ʿAlī al-Hanafī al-Ṭarsūsī, the possibility of resorting to the imposition of new taxes or the requisition, on the order of the sultan, of goods to finance a war effort was discussed by several ʿulamāʾ at different times.[1] In accordance with those previous opinions, al-Ṭarsūsī deems it illegal for the authorities to take property from Muslims to finance a war unless the bayt al-māl is empty. However, if Muslims wish to give of their own accord, there is no harm in doing so.[2] If the resources of the bayt al-māl are not sufficient, the sultan is allowed to request the financial support of individuals with means, as did the Caliphs Abū Bakr and ʿUmar with some well-off people.[3]

Badr al-Dīn b. Jamāʿa adds an essential element: if the bayt al-māl has a surplus, according to Abū Ḥanīfa, it must be used to help Muslims in the event of a disaster; for al-Shāfiʿī, it must be spent on the maintenance of fighters, stables, horses, strongholds and the acquisition of weapons.[4] This last opinion is also shared by the Mālikīs, especially Ibn Ḥājīb.[5]

The defence of the Muslim population is, with the guarantee of a minimum standard of living, one of the main goals of Islamic law (maqāṣid al-sharīʿa) and the Islamic state.[6] For this pattern, the Islamic state can allow additional taxes.[7] In this case, the concept of maṣlaḥa (public good) is evident and fundamental.[8] During the 7th/13th – 8th/14th century, the Muslim territories of the Middle East, especially the Mamlūk Sultanate, were threatened by several dangers: the Mongols in the East, the Crusader states in Syria and the launching of a potential Crusade from the West, and the Armenians in the North, who were the allies of the Mongols. In the face of this “mortal threat,”[9] the imposition of mukūs had to be considered as a primordial necessity given that Dār al-Islām’s existence was threatened according to Ibn Taymiyya.[10] For Ibn Taymiyya, the Mamlūks were al-ṭāʾifa al-manṣūra (the Victorious group), the only ones fighting the Mongols and saving Islam.[11] The image of the Mamlūks as cantors of Islam and champions of jihād could legitimate the imposition of new taxes. Baybars’ response to the letter of al-Nawawī, discussed in the second post of this series, corroborates this hypothesis.

Question: What Property of Muslims Taken by Infidels May Be Taken by Muslims as Part of the Jihād?

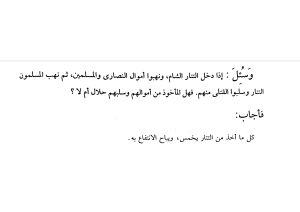

Regarding the property and lands of Muslims initially taken by infidels and then recovered by Muslim authorities as ghanīma (spoils of war) or fayʾ, should these properties be returned to their owners, or do they become part of the al-amwāl al-sulṭāniyya (property of the sultanate)? This question led to divergences between the ʿulamāʾ, and a host of opinions exists on the subject. For Ibn Taymiyya, the answer is affirmative:

“[…] if the Mongols attack Syria and plunder the property of Muslims and Christians and then the Muslims attack the Mongols and plunder the property of their slain, is what was taken by them lawful or not? He replied: ‘Everything that has been taken from the Mongols is divided into five parts, and it is allowed to profit from it’.”[12]

Far from being a topic of mere theoretical discussions among ʿulamāʾ, these questions concerned real situations. The valuable account of Ibn Kathīr, a pupil of Ibn Taymiyya, on the fate of the territories of Antioch after the conquest of the city by Baybars in Ramaḍān 666/May 1268 clearly demonstrates the importance of these issues:

“He (Baybars) decided to take many territories, villages and fields that were under his authority (of Antioch) on the pretext that the Mongols had imposed their suzerainty on the latter and that he (Baybars) had delivered it. Some jurists among the Ḥanafīs allowed him to do this by issuing a fatwā based on the fact that when the infidels take something from the property of Muslims, it becomes their property and when it is recovered from their hands, it does not return to its [Muslim] owners. This question is well-known and there are two opinions: the most correct is that of the majority of ʿulamāʾ, according to which it is necessary to return the property to its Muslim owner according to the ḥādīth of al-ʿAḍbā’, the camel of the Prophet – may the mercy and salvation of God be upon him – that the Prophet of God – may the mercy and the salvation of God be upon him – recovered after the associates took it from him. They take this ḥādīth and others as proof by following Abū Ḥanīfa – may God have mercy on him. Furthermore, other ʿulamāʾ have said: if the unbelievers take the goods of the Muslims, then they convert to Islam and remain in possession of these goods, then they remain in their possession and that according to the word of the Prophet – may the Mercy and the Salvation of God be upon him – : ‘And did ʿAqīl leave us a home?’[13] ʿAqīl had taken possession of the property of Muslims who had emigrated from Mecca, and he converted while still having these goods, which were not taken back from him. But if they had been taken from him before his conversion, then the goods would be returned to their owner according to the ḥādīth of al-ʿAḍbā’.

Let us go back to our story: al-Ẓāhir Baybars convened a meeting with the judges and jurisconsults of all the legal schools. The sultan persisted in this opinion (to take possession of the ancient territories of the region of Antioch) by relying on the fatwās he had obtained, and people were afraid of that. That was when Fakhr al-Dīn b. al-Wazīr Bahāʾ al-Dīn al-Ḥinnā, who had taught the Shāfiʿī madhhab following Ibn bint al-Aʿazz, intervened and said: ‘O Khūnd,[14] the locals will give you in exchange for all this a thousand dinars in several instalments, 200,000 dirhams to be paid each year.’ Baybars refused this proposal unless the money was paid in the days that followed, and he left Syria for Cairo. And he had already responded to the proposal by accepting it. The good news arrived and the letter was read publicly from the minbar, which pleased the people. Baybars decreed that a first payment of 400,000 dirhams must be made and that the land revenues, which the inhabitants had taken care of at the time they were cultivated and shared, are theirs. And this gesture dissipated the fears of the population vis-à-vis the sultan.” [15]

The above account from Ibn Kathīr is interesting in more than one way. It highlights the position of the Ḥanafīs on the subject, as well as the evidence upon which both the Ḥanafīs and the majority of the ʿulamāʾ based their opinions – also supported by a prophetic ḥādīth – which is contrary to that of the Ḥanafīs, namely that a Muslim owner has the right to recover his property. The position adopted by the Ḥanafīs was also based on the expedition of Khaybar in Muḥarram 7/May 628 when the Prophet, after the conquest, divided the spoils among his Companions after taking one fifth for himself. Consequently, a ruler can choose to divide conquered land among his combatants, allow the inhabitants to recover their ownership thereof, or keep it for himself.[16] Ibn Taymiyya has a similar opinion.[17] For some Mamlūk authors, such as Ibn Shaddād and al-Nuwayrī, there exists a distinction between the lands belonging to infidels (such as those conquered by Baybars) and those annexed from Muslim powers.[18]

The position of al-Qarāfī and other Mālikī ʿulamāʾ is opposed to that of the Ḥanafīs and Ibn Taymiyya: if goods, a slave or any other property belonging to a Muslim is taken by infidels and then taken back by Muslims as booty, then the Muslim owner, should he recognize his property or slave before the sharing of the booty, is most entitled to recover it.[19] However, al-Qarāfī takes this further. In his famous al-Dhakhīra, one of the most important books on Mālikī fiqh, al-Qarāfī dedicates an entire sub-chapter to the fate of the property and people belonging to Muslims who fell into the hands of infidels before Muslims once again took possession of them. Al-Qarāfī organizes his remarks into twelve points, each of which deals with a specific situation, and he presents various opinions of great Mālikī ʿulamāʾ and other authorities. Among the few cases mentioned are the following: if people of Dār al-ḥarb (the abode of war) capture a dhimmī whom Muslims later capture, is that individual considered fayʾ? If infidels kidnap a Muslim or dhimmī woman, who then gives birth at home and is later taken prisoner by Muslims, what happens to the child and his or her mother? If an unbeliever travels to Islamic lands to convert, leaving behind his possessions and his family to be subsequently captured by Muslims, does this individual have the right to retrieve them after becoming a Muslim?[20] These examples, along with many others, indicate both the complexity of the subject and the richness of opinions on and interpretations of it, which vary according to context and the madhhab.

Conclusion

It is obvious that the many accounts of ʿulamāʾ’s opposition to allow new taxation for funding jihād discussed so far employ “literary strategies” consisting in presenting the superiority of the ʿulamāʾ over the rulers, of the religious over the politics. Despite that caveat, the initial analysis indicates that certain ʿulamāʾ had significant influence and could even stand up to the sultan. Thus, they represented a sort of counter-power against the authority of the ruler.[21] The opposition of the ʿulamāʾ in the accounts discussed so far invalidates or at least qualifies the thesis of Emmanuel Sivan regarding the total submission of the ʿulamāʾ to the ruling Mamlūk class. The review of political-religious and fiqh treaties highlights the existence of well-defined and strict regulations regarding the financing of jihād in Islamic law. The imposition of taxes on a population, even in the context of the financing of jihād, is considered illegal except in specific situations, and it can only be countenanced should the relevant authorities no longer have the resources required to equip an army in response to a threat. The latter case attests to the extreme importance of taking into account the specificities of the context in a legal opinion or fatwā, thus showing the flexibility and pragmatic approach of Islamic law. According to Badr al-Dīn b. Jamāʿa and Ibn Taymiyya, the payment, equipment, provisioning of fighters and the thughūr (strongholds) are obligations incumbent, at first, only on the authorities.[22] In practice, it appears that the Mamlūk rulers often imposed additional taxes and, in most cases, disregarded the rules of the sharīʿa regarding not only the collection of taxes but also expenditure. Nevertheless, from the point of view of Islamic law, the imposition and collection of taxes outside those identified in the Qur’ān and the prophetic tradition without a valid reason and when the bayt al-māl is not empty, are considered forbidden by the majority of the madhāhib, even if the ruler wants to use these taxes to finance jihād. That being said, these preliminary results are not definitive and should be complemented by the analysis of a larger corpus over a longer time period.

Notes:

[1] Al-Ṭarsūsī, Tuḥfat al-Turk fīmā yajibu an yuʿmal fī l-mulk, ed. ʿAbd al-Karīm Muṭīʿ al-Ḥamdāwī (Damascus, 2000), 121.

[2] Ibid. 204.

[3] Ibid.

[4] Badr al-Dīn b. Jamāʿa, Taḥrīr al-aḥkām fī tadbīr ahl al-Islām, ed. Fu’ād ʿAbd al-Munʿim (Qatar, 1985), 151.

[5] Al-Qarāfī, al-Dhakhīra, eds. Muḥammad Ḥajjī, Saʿīd Aʿrāb and Muḥammad Būkhubza (Beirut, 1994), 3:432.

[6] Volker Nienhaus, “Zakat, taxes and public finance in Islam,” in Islam and the Everyday World: Public Policy Dilemmas, eds. Sohrab Behdad and Farhad Nomani (NewYork: Routledge, 2008), 183.

[7] Monzer Kahf, “Taxation policy in an Islamic Economy,” in Fiscal Policy and Resource Allocation in Islam, eds. Ziauddin Ahmed, Munawar Iqbal and M. Fahim Khan (Jeddah: International Centre for Research in Islamic Economics), 119.

[8] Abdul Aziz bin Sattam, Sharia and the Concept of Benefit: The Use and Function of Maslaha in Islamic Jurisprudence (London and New York: I. B. Tauris, 2005), 5-28.

[9] Stephen Humphreys, “Ayyubids, Mamluks, and the Latin East in the Thirteenth Century,” Mamluk Studies Review 2 (1998): 15.

[10] Ibn Taymiyya, Jihād, ed. ʿAbd al-Raḥmān ʿUmayra (Beirut: Dār al-Jīl, 1997), 2:142-43. On Ibn Taymiyya and the Mongols see Yahya Michot, Muslim Under Non-Muslim Rule (London: Interface Publications, 2006), 65; Yahya Michot, “Textes spirituels d’Ibn Taymiyya. XI: Mongols et Mamlūks: l’état du monde musulman vers 709/1310” (available at www.muslimphilosophy.com/it/works/ITA%20Texspi%2011.pdf); Yahya Michot, “Textes spirituels d’Ibn Taymiyya. XII: Mongols et Mamlūks: l’état du monde musulman vers 709/1310” (available at www.muslimphilosophy.com/it/works/ITA%20Texspi%2012.pdf); Yahya Michot, “Textes spirituels d’Ibn Taymiyya. XIII: Mongols et Mamlūks: l’état du monde musulman vers 709/1310” (available at www.muslimphilosophy.com/it/works/ITA%20Texspi%2013.pdf); Denise Aigle, “A Religious Response to Ghazan Khan’s Invasions of Syria. The Three “Anti-Mongol” fatwās of Ibn Taymiyya,” in The Mongol Empire between Myth and Reality. Studies in Anthropological History, ed. Denis Aigle (Boston and Leyde: Brill, 2016), 283-05; Denise Aigle, “Ghazan Khan’s Invasion of Syria. Polemics on his Conversion to Islam and the Christian Troops in His Army,” in The Mongol Empire between Myth and Reality. Studies in Anthropological History, ed. Denis Aigle (Boston and Leyde: Brill 2016), 255-82.

[11] Mehdi Berriah, “The Mamluk Sultanate and the Mamluks Seen by Ibn Taymiyya between praise and criticism,” Arabian Humanities 14 (2020) available at https://doi.org/10.4000/cy.6491.

[12] Ibn Taymiyya, al-Jihād, 2:182.

[13] The complete ḥādīth is reported by al-Bukhārī and Muslim according to Usāma b. Ziyād b. al-Ḥāritha.

[14] A term with which one addressed the sultan, the amīrs and any person of high rank in the Mamlūk period.

[15] Ibn Kathīr, al-Bidāya wa-l-nihāya, 17:477-78.

[16] Ann K. S. Lambton, State and Government in Medieval Islam (Oxford: Oxford University Press, 1981), 216-17. On the status of land in Islamic Law see Paul G. Forand, “The Status of the Land and Inhabitants of Sawad during First Two Countries of Islam,” Journal of Islamic and Social History of the Orient 14 no. 1 (1971): 25-37; A. N. Poliak, “Classifications of Lands in the Islamic Law its Technical Terms,” American Journal of Semantic Languages and Literature 57, no. 1 (1940): 50-62. See also Hossein Modarressi Tabātabāi, Kharāj in Islamic Law (London: Anchor Press, 1983).

[17] Ibn Taymiyya, Majmūʿ al-fatāwā, ed. Wizārat al-shu’ūn al-islāmiyya wa-l-irshād al-Saʿūdiyya (Riyadh, 2004), 28:581-82.

[18] Anne Troadec, “Baybars and the Cultural Memory of Bilād al-Shām: The Construction of Legitimacy,” Mamluk Studies Review 18 (2014-2015): 122-23.

[19] Al-Qarāfī, al-Dhakhīra, eds. Muḥammad Ḥajjī, Saʿīd Aʿrāb and Muḥammad Būkhubza (Beirut, 1994), 3:434.

[20] Ibid. 3:434-35, 439-40.

[21] Sylvie Denoix, “Construction normale et rapport à la norme d’un groupe minoritaire dominant: les Mamlouks (1250-1517),” in Minorités et régulations sociales en Méditerranée médiévale: actes du colloque réuni du 7 au 9 juin 2007 en l’Abbaye royale de Fontevraud (Maine-et-Loire). Préface de Monique Bourin, eds. Stéphane Boisselier, François Clément, John Victor Tolan and Monique Bourin (Rennes, Presses universitaires de Rennes, 2010), 140.

[22] Badr al-Dīn b. Jamāʿa, Taḥrīr al-aḥkām fī tadbīr ahl al-Islām, ed. Fu’ād ʿAbd al-Munʿim (Qatar, 1985), 85, 97; Ibn Taymiyya, al-Siyāsa al-sharʿiyya fī iṣlāḥ al-rāʿī wa-l-raʿiyya, ed. Saʿd b. al-Murshidī al-ʿAtībī (Riyadh, 2015), 155-57. See also al-Ṭarsūsī, Tuḥfat al-Turk fīmā yajibu an yuʿmal fī l-mulk, ed. ʿAbd al-Karīm Muṭīʿ al-Ḥamdāwī (Damascus, 2000), 177.

(Suggested Bluebook citation: Mehdi Berriah, A Lack of Resources in the bayt al-māl: A Sine Qua Non Condition for the Imposition of a Tax?, ISLAMIC LAW BLOG (Sept. 30, 2021), https://islamiclaw.blog/2021/09/30/a-lack-of-resources-in-the-bayt-al-mal-a-sine-qua-non-condition-for-the-imposition-of-a-tax/)

(Suggested Chicago citation: Mehdi Berriah, “A Lack of Resources in the bayt al-māl: A Sine Qua Non Condition for the Imposition of a Tax?,” Islamic Law Blog, September 30, 2021, https://islamiclaw.blog/2021/09/30/a-lack-of-resources-in-the-bayt-al-mal-a-sine-qua-non-condition-for-the-imposition-of-a-tax/)